work opportunity tax credit questionnaire social security number

There are two sets of frequently asked questions for WOTC customers. Work opportunity tax credit questionnaire ssn.

What Is A Tax Credit Screening When Applying For A Job Welp Magazine

Asking for the social security number on an application is legal in most states but it is an extremely bad practice.

. Employers must apply for and receive a certification verifying the new hire is a member of a targeted group before they can claim the tax credit. April 27 2022 by Erin Forst EA. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the.

WOTC is a federal tax credit program available to employers who hire and retain veterans and individuals from other target groups that may have challenges to securing employment. The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers. When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training.

The owners of the site is Walton management services and it says our company is participating in a federal jobs tax credit program called the work opportunity tax credit program. There are two sets of frequently asked questions for WOTC customers. Some states prohibit private employers from collecting this.

Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire. There are two sets of frequently asked questions for WOTC customers. Questions and answers about the Work Opportunity Tax Credit program.

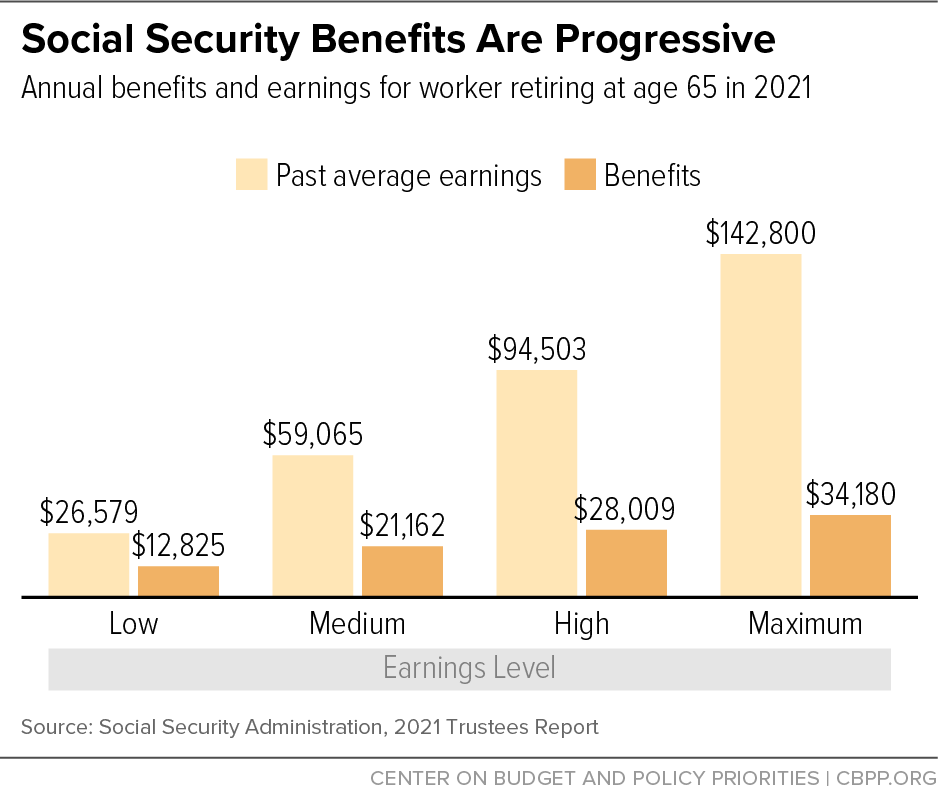

Companies hiring long-term unemployed workers receive a tax credit of 35 percent of. The credit will not affect the employers Social Security tax liability reported on the organiz See more. Qualified tax-exempt organizations will claim the credit on Form 5884-C Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans as a credit against the employers share of Social Security tax.

The Work Opportunity Tax Credit offers tax benefits for businesses that hire employees that are considered by the IRS to be in targeted groups. Your name social security number a street address where you live city or town state and zip code county telephone number. The Work Opportunity Tax Credit is a voluntary program.

A work opportunity tax credit questionnaire helps to find out whether a company is following the Work Opportunity tax credit program as directed by the Federal government. Work Opportunity Tax Credit. Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire.

A company hiring these seasonal workers receives a tax credit of 1200 per worker. The WOTC promotes the hiring of individuals who qualify as members of target groups by providing a federal tax credit incentive of up to 9600 for employers who hire them. Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the.

The WOTC forms are federal forms to help determine if you will make your employer eligible for a tax credit when they hire you. The forms require your identifying.

What New Pay Transparency Laws Could Mean For U S Workers Forbes Advisor

6 Benefits Of Filing Your Taxes Early Ramsey

Should You Add Your Social Security Number On A Job Application What Are Some Alternatives Choices To Take Quora

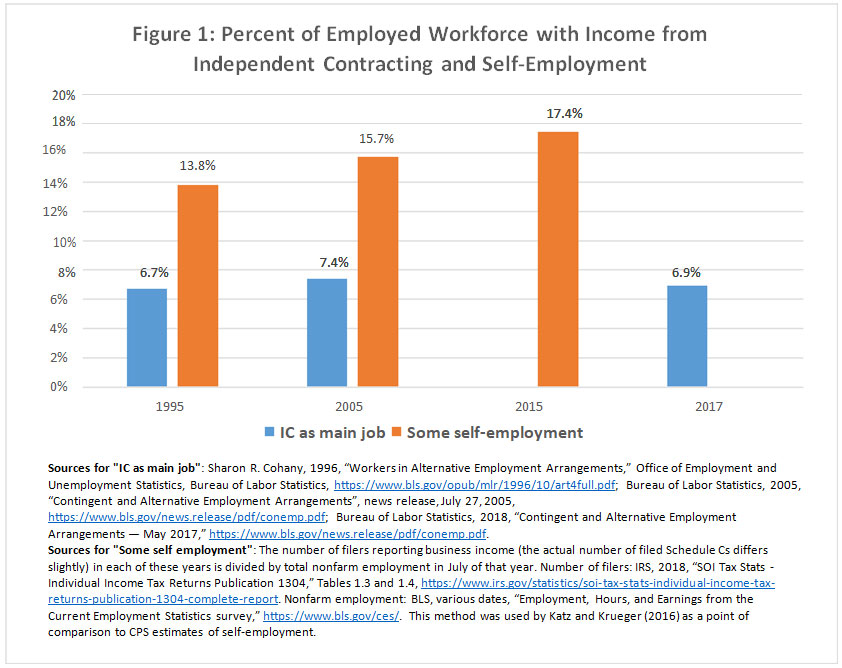

Social Security And Independent Contractors Challenges And Opportunities National Academy Of Social Insurance

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credits Redfworkshop

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Fillable Online Tax Credit Questionnaire Fax Email Print Pdffiller

Federal Wotc And Local Tax Credit Assistance Maximus Tces

Work Opportunity Tax Credit Department Of Labor Employment

Edocument Equifax Edoc Avionte Classic

Job Application Requires Social Security Number Field Geologist Wtf R Geologycareers

Work Opportunity Tax Credit What Is Wotc Adp

Top Paid Medical Surveys In 2022 Physician On Fire

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

Irs Data Retrieval Tool Finaid

Findings Minnesota Department Of Employment And Economic Development